Suppose you are going through a cash crunch, and do not own any property or other assets such as gold. Under such circumstances, the simplest solution for you is to avail yourself of a collateral-free personal loan. However, before initiating the loan application procedure, such a borrower must know the intricacies of unsecured personal loans. First, let’s understand, what is collateral?

What Is Collateral?

Collateral is any asset that you can use as security to get a loan or credit from financial institutions. In most circumstances, you can use an immovable property as security. Other valuables, such gold and financial securities, can also be pledged in some instances.

The documentation process for loans with collateral is often lengthy. Before extending a loan offer, banking institutions will additionally examine and confirm the legitimacy of the pledged asset.

What Is A Collateral Free Personal Loan?

Collateral-free loans are essentially unsecured forms of credit that don’t require any security. Since no guarantee is required in order to get these types of credit, the risk associated with unsecured loans continues to be higher than that of secured loans.

To keep their EMIs manageable, borrowers should choose a lesser loan amount or a longer repayment period.

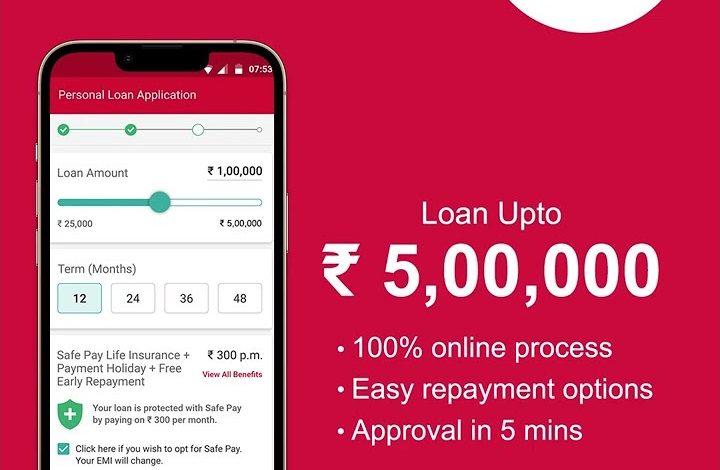

Home Credit offers collateral-free personal loan of up to Rs. 5 lakhs with instant approval & flexible repayments. Also, the application process involves minimal documentation.

To avail of an instant personal loan for fulfilling your urgent financial requirements, download the Home Credit personal loan app now!

Features & Benefits of Collateral Free Personal Loan

Here are some features and benefits that unsecured personal loans come with:

Flexible Repayment Terms

Personal loans without collateral usually provide you with the option to select a flexible repayment period. If you want to make your EMIs more manageable, you can easily choose a longer payback period.

No End-Use Restrictions

You can use a personal loan to fulfil any financial need in addition to having access to a large sum of money without having to pledge any assets. The no end-use limitation feature enables borrowers to use the funds to meet a variety of financial needs, such as higher education costs and expenses during medical emergencies, among others.

Easy Eligibility Criteria

Simple eligibility requirements can be readily completed when applying for a personal loan without collateral. Although different lenders may have varied eligibility requirements, the fundamental standards are the same. Before applying for an unsecured loan, make careful to familiarize yourself with the eligibility requirements and the paperwork needed.

In addition to these advantages, this type of financial support offers pre-payment options. However, if you intend to prepay your personal loan, be careful to check the fees involved beforehand.

Pros & Cons of Collateral Free Personal Loan

Pros

- With a collateral free loan, you can anticipate receiving your money more quickly than with a secured loan, which can call for extra paperwork like a car’s title as proof of ownership.

- In contrast to a secured loan, if you default on an unsecured loan, the lender cannot seize your property.

- Excellent credit score borrowers may be eligible for rates as low as those on secured loans.

Cons

- Collateral free loans might have higher interest rates since they are riskier for lenders, especially for customers with poor credit.

- Your credit score may suffer if you are late on an unsecured loan. The remaining loan sum could be sold to a debt collection company, resulting in calls from an unknown company seeking payment, and you might be sued in an effort to recover the debt.

How To Apply for Collateral Free Personal Loan with Home Credit?

The process to apply for an instant personal loan at Home Credit is mentioned below:

Step 1 – Download the Home Credit App & Register

Download the Home Credit personal loan app from the Google play store & register with your mobile number.

Step 2 – Complete Your Instant Personal Loan Application

Fill in your required personal details and complete your application.

Step 3 – Enjoy Instant Loan Approval with Quick Disbursal

Enjoy hassle-free loan approval & quick funds disbursal directly to your account within a few hours!

It is also advisable to choose your EMI amount before submitting the loan application. This way, by knowing how much you will need to pay each month to repay the loan, you can better manage your finances.

If you are wondering what makes collateral free loans from Home Credit better, then it has to be its complete paperless process. You can just use your identity & address proof for verification during documentation and expect the funds to be disbursed within minutes.

Final Word

Collateral-free personal loans may have additional terms and conditions because they are unsecured in nature. Before beginning the application process, make sure you have checked everything. To ensure that the cost of borrowing the funds is reasonable, it is also wiser to evaluate the offerings made by several lending institutions.